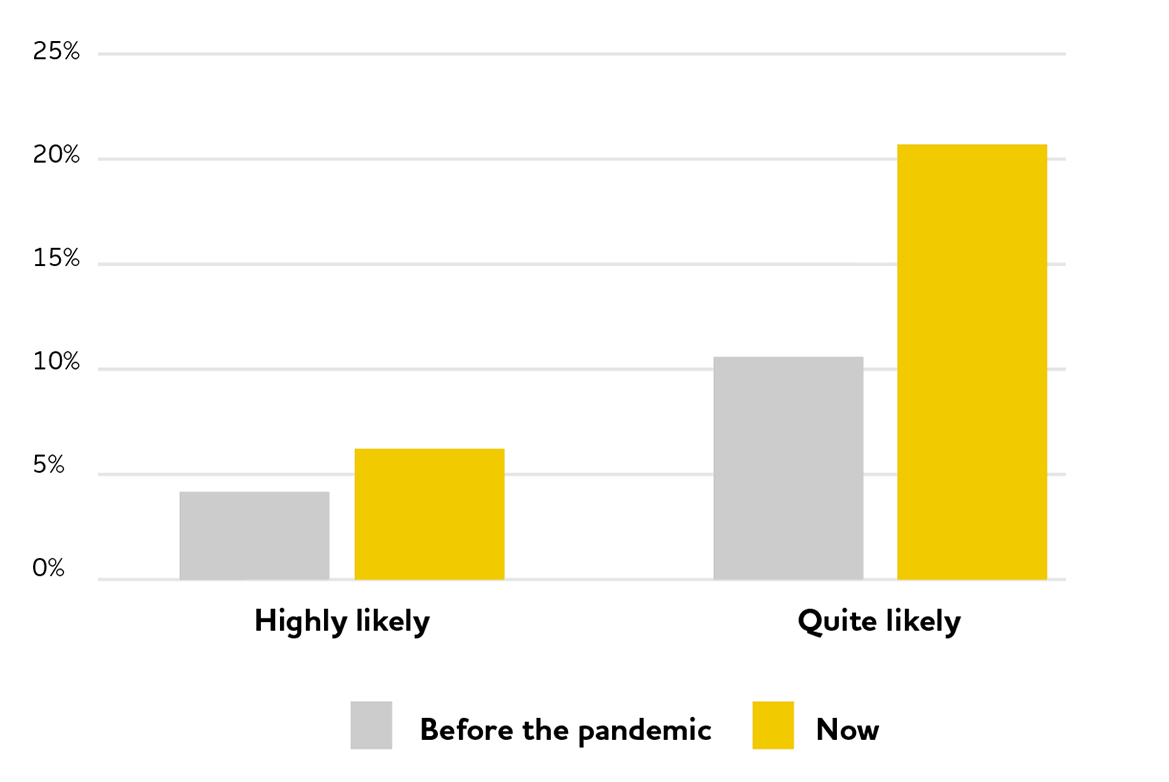

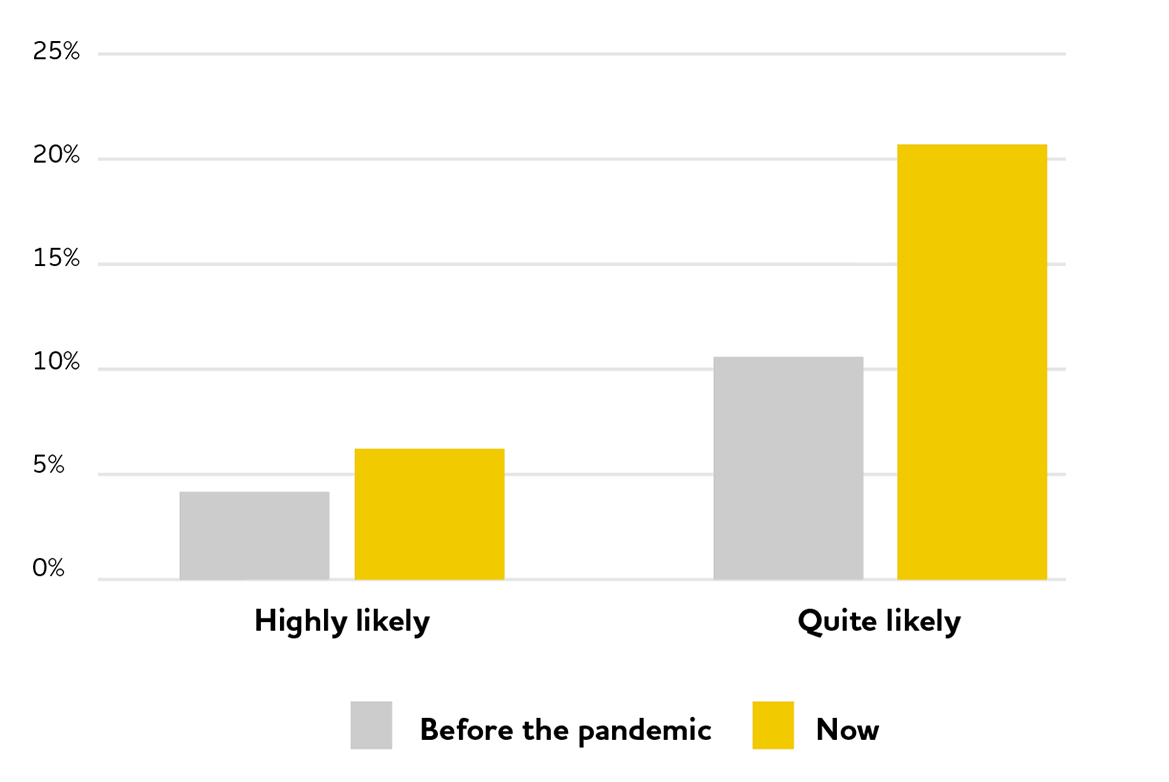

A nationwide survey of 1,049 by Consumer Intelligence for health insurance provider Equipsme shows that 15% said they were likely to have considered paying for private treatment or insurance before the pandemic. The figure has nearly doubled to 27% post-coronavirus.

Fig 1: How likely were/are you to consider paying for private treatment yourself, or buying health insurance, to ensure being seen quickly by a specialist, should a GP refer you on?

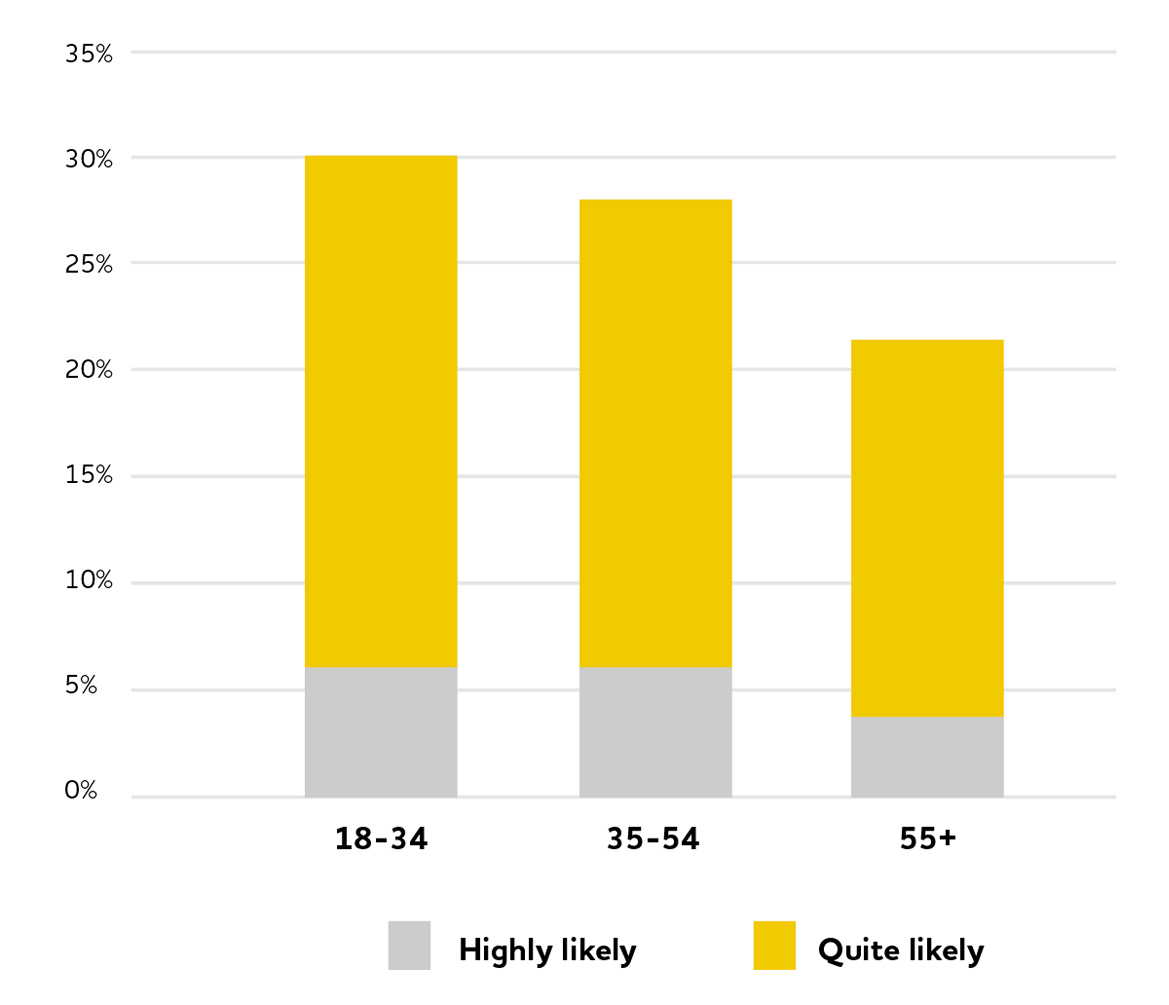

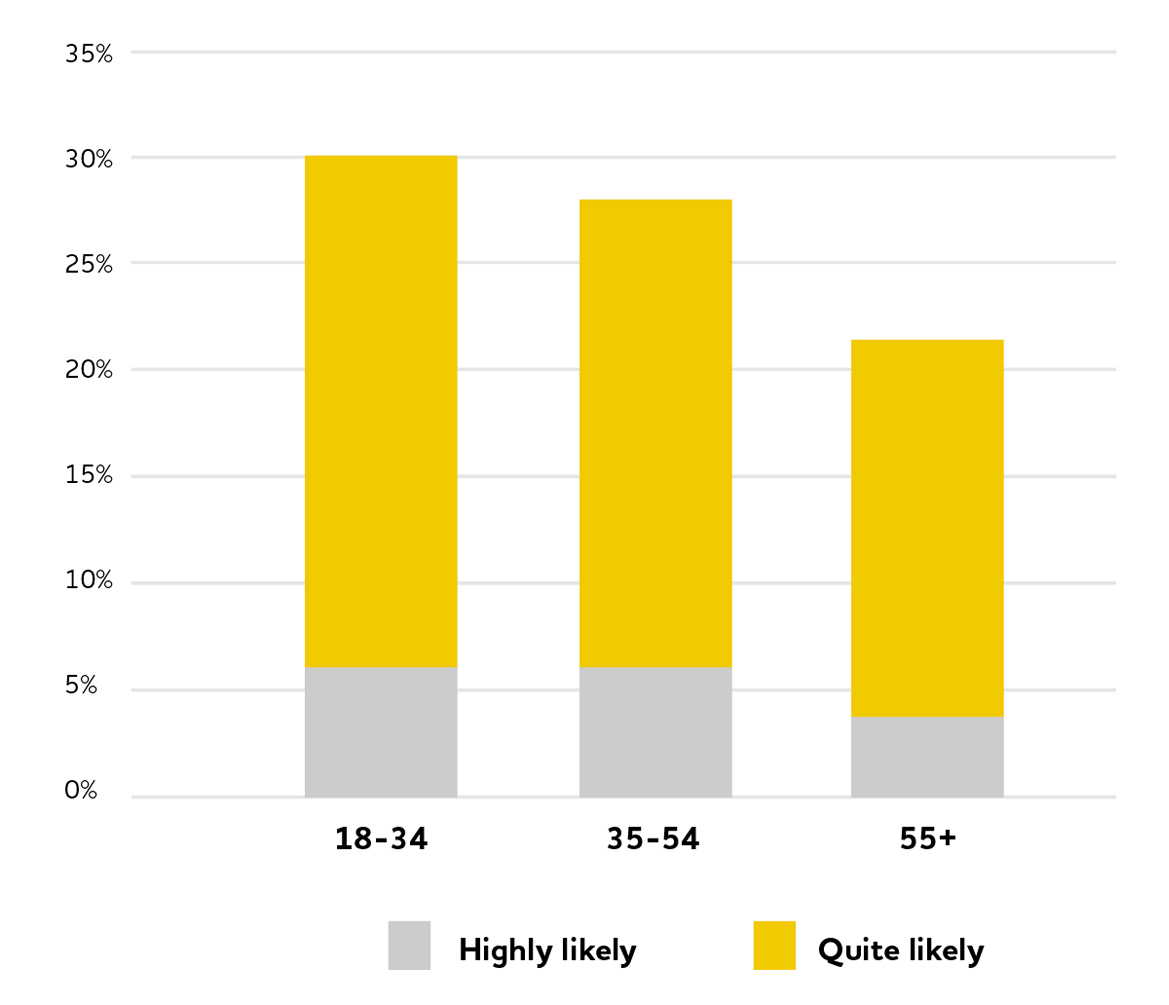

Younger people are the most likely to consider paying privately for healthcare, with 30% of respondents aged 18-34 answering this way, compared to 22% of respondents aged 55 and over.

Fig 2: Younger people more likely to consider private treatment or health insurance.

Concerns about waiting times for specialist treatment was the top reason given by those who said they would consider health insurance or paying a private hospital directly for treatment.

Matthew Reed, Managing Director at Equipsme, explains: “People are inevitably thinking more about their health, and prioritising how they look after themselves and their families. The result is that interest in private medical insurance is actually rising – which at a time when many are facing financial hardship is pretty remarkable.”

The NHS Confederation warned earlier this month that the Covid-19 crisis could see the number of people waiting for NHS treatment double to 10 million by the end of the year due to a backlog of cases, maintaining social distancing, and staffing.

Some 76% of people say they are now concerned about NHS waiting lists, and 67% are worried about the NHS’s ability to deal with non-urgent and non-Covid related illnesses and ailments.

“If we’ve learnt anything over the last three months we’ve learnt how much people love and value the NHS - but they’re also worried about it,” says Matthew. “More than three quarters are concerned about waiting times as it tries to catch up with itself after Covid. Private medical insurance is a way of protecting themselves and their families - and protecting the NHS by taking some of the pressure off it.”

The survey also showed health insurance rising up the wish list of employee benefits – falling behind pensions and flexible working, but ahead of gym membership, childcare vouchers and a company phone.

Most valuable benefits

1. Pension

2. Flexible working

3. Income protection

4. Health insurance

5. Critical illness protection

6. Life insurance

7. Car parking

8. Mobile phone

9. Gym membership

10. Childcare vouchers

Matthew said: “Employers in particular can take note that this is something that people are increasingly interested in. Now more than ever we know how important it is to protect your workforce, and look after the people that make your business wheels go round. The working world has changed for good, and beer-and-pizza benefits in kind just aren't going to cut in anymore.

“Traditionally private medical insurance has been for big executives in big businesses, or via a cash plan scheme which requires staff to shell out and be reimbursed. At Equipsme we think healthcare plans can work for any size of business, and any employee, without the upfront payments, the jargon, or the complications. It’s our aim to make it both practical and affordable, which is why our basic plans start at just £9 per person per month.”

Ends

Notes to Editors

Consumer Intelligence online survey conducted 19-22 June 2020 with 1,049 adults in the UK

About Equipsme

Equipsme provides simple and practical health plans for businesses with more than one employee in partnership with a range of partners including AXA Health Limited, HealthHero, Health Assured and Thriva. Equipsme was the first new health provider in over a decade when it launched in March 2018. It won “Best New Product - Innovation Award” at the Cover Excellence Awards in October 2019.

For press enquiries contact [email protected]

Article originally created July 2020